Property taxes are one of those responsibilities that sound simple until you actually have to deal with them. Many homeowners in Tuscarawas County feel stuck at the same starting point. They don’t know where to pay, whether online payment is allowed, what fees apply, or what happens if they miss the deadline. The confusion is worse for first-time buyers, elderly owners, and anyone who lost their tax bill.

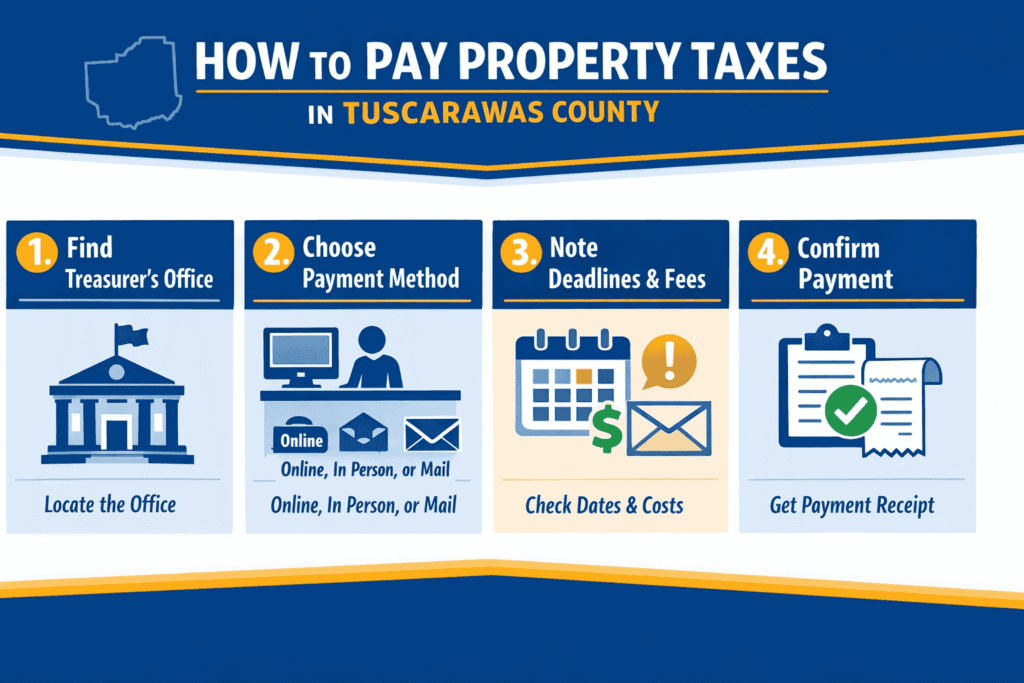

This guide exists to remove that confusion completely. By the time you finish reading, you will know exactly where to pay your property taxes in Tuscarawas County, how to pay them, what deadlines matter, and how to confirm your payment without second-guessing yourself.

Quick Summary Before You Start

If you only have a minute, this section gives you the essentials. Full explanations follow below, so you can return later if needed.

- Property taxes are paid to the Tuscarawas County Treasurer’s Office

- Online, in-person, and mail payments are available

- Online payments may include processing or convenience fees

- Taxes are usually due in two installments each year

- Late payments can lead to penalties and interest

- You can look up your tax bill using your parcel number

- Third-party payments are allowed

- Payment confirmations are provided for proof

Where Do I Even Pay My Property Taxes in Tuscarawas County?

The most common mistake homeowners make is starting in the wrong place. Property taxes in Tuscarawas County are not paid to the auditor, the recorder, or the city office. They are paid only through the Tuscarawas County Treasurer’s Office.

The Treasurer’s Office is the official tax payment office responsible for collecting real estate taxes for all properties in the county. Whether you choose to pay online, by mail, or in person, every payment is processed through this office.

The safest way to pay is always through the official Tuscarawas County Treasurer website or directly at the Treasurer’s physical office located at the county courthouse in New Philadelphia, Ohio. Using unofficial websites can cause delays, incorrect postings, or even failed payments.

Can I Pay Property Tax Online or Do I Have to Go in Person?

Yes, you can pay your property taxes online in Tuscarawas County, and many homeowners prefer this option because it saves time and provides instant confirmation. Online payment is available through the county treasurer portal and can be accessed at any time, including evenings and weekends.

Online payment is especially helpful if you live outside the county, own multiple properties, or are paying close to the deadline. In-person payment is still available for those who prefer face-to-face service or need to pay with cash.

When paying online, you will be asked to enter your parcel number or property details, select the amount you want to pay, choose a payment method, and confirm the transaction. Once completed, a confirmation receipt is generated for your records.

What Payment Methods Are Accepted?

Knowing what payment methods are accepted ahead of time prevents unnecessary trips or failed transactions. Tuscarawas County accepts multiple forms of payment, but availability can depend on whether you pay online or in person.

Credit cards and debit cards are widely accepted for online tax payments, while checks and cash are typically used for in-person transactions. Mailed payments should always be made by check and include your parcel number to avoid misposting.

Accepted payment methods include:

- Credit cards for online payments

- Debit cards for online and in-person payments

- Personal or bank checks

- Cash for in-person payments only

If you are paying by check, make it payable to the Tuscarawas County Treasurer and mail it early enough to arrive before the due date.

Are There Extra Fees for Paying Online?

This is one of the biggest concerns for homeowners, and it’s valid. Online property tax payments usually include a convenience or processing fee. This fee is not set by the county itself but by the third-party payment processor that handles electronic transactions.

Credit card payments typically carry a percentage-based service fee, while debit card payments may have a smaller flat fee. If an electronic check option is available, it often has the lowest fee.

To help you decide, here is a simple comparison.

| Payment Method | Extra Fees | Processing Speed |

|---|---|---|

| Online credit card | Yes | Immediate |

| Online debit card | Usually | Immediate |

| Check by mail | No | Slower |

| In person (cash or check) | No | Same day |

If avoiding extra charges is important to you, paying by check or visiting the Treasurer’s Office in person is usually the most cost-effective option.

When Are Property Taxes Due in Tuscarawas County?

Property taxes in Tuscarawas County are typically due in two installments each year. These are often referred to as the first half and second half payments.

The first installment is usually due in January, while the second installment is commonly due in June or July. The exact dates can change slightly from year to year, so it is important to check your current tax bill or the official county treasurer website for confirmation.

If a due date falls on a weekend or legal holiday, payments are generally accepted on the next business day without penalty. Waiting until the last day, however, always carries some risk due to processing delays.

What Happens If I Miss the Property Tax Deadline?

Missing a property tax deadline does not mean immediate legal trouble, but it does create financial consequences. Once a payment becomes late, penalties and interest begin to apply.

Late payments can result in additional charges added to your balance each month. If taxes remain unpaid for an extended period, the property may become tax delinquent and could eventually face a tax lien.

The most important thing to remember is that ignoring the issue makes it worse. Even making a partial payment can reduce penalties and show good faith while you work toward resolving the balance.

How Do I Find My Property Tax Bill or Parcel Number?

Losing your tax bill does not cancel your responsibility to pay, but it also does not trap you. Tuscarawas County provides online tools that allow you to search for your property tax information.

You can find your parcel number by searching the county property records using your name or property address. Once located, the parcel number allows you to view your tax balance, installment amounts, payment history, and due dates.

This lookup tool is especially useful for first-time homeowners, investors, or anyone who did not receive a mailed bill.

Can Someone Else Pay My Property Taxes for Me?

Yes, Tuscarawas County allows third-party property tax payments. This option is commonly used by family members, caregivers, property managers, and real estate investors.

As long as the person paying has the correct

, they can submit payment online or in person. Ownership of the property does not change simply because someone else pays the taxes.

Payment receipts can usually be downloaded or emailed, making it easy for both the payer and the property owner to keep records.

Is There a Payment Plan or Property Tax Relief Option?

If you are experiencing financial difficulty, Tuscarawas County offers limited relief options designed to reduce tax burden for qualifying homeowners. These options are meant to help, not punish.

Relief programs may include installment arrangements in certain cases, homestead exemptions, senior citizen reductions, or disability-based tax relief. Eligibility depends on income, age, disability status, and residency requirements.

Applications are typically handled through the county auditor or treasurer and must be submitted before specific deadlines. Waiting too long can limit your options.

How Do I Know My Payment Went Through?

Trust is earned, especially when money is involved. Tuscarawas County provides multiple ways to confirm that your property tax payment was successfully processed.

Online payments generate an immediate confirmation screen and often an email receipt. These records include transaction details, payment date, and confirmation numbers. In-person payments provide stamped receipts, while mailed payments are reflected in your online payment history once processed.

Always save your receipt. It is your proof if questions arise later.

Final Thoughts

Paying property taxes in Tuscarawas County does not have to be confusing or stressful. Once you understand where to pay, how to pay, and what deadlines matter, the process becomes manageable. Using official tools, keeping records, and paying on time protects both your finances and your peace of mind.

This guide is designed so you never have to guess again.

FAQs

Can I pay only one installment instead of the full tax amount?

Yes. As long as you pay the required amount for the current installment by its due date, you can pay in halves.

Is it safe to pay property taxes online?

Yes, when payments are made through the official Tuscarawas County Treasurer portal. Avoid unofficial or third-party websites.

Can I pay property taxes for multiple parcels?

Yes. Each parcel must be paid separately, but the online system allows multiple payments in one session.

What should I do if I think my tax bill is wrong?

Contact the Tuscarawas County Treasurer’s Office directly. They can review payment records and guide you on corrections.