Owning farmland in Tuscarawas County comes with unique benefits but it also brings its own set of challenges. Many farmers and landowners feel confused about which lands qualify for agricultural tax exemptions, how the CAUV program works and whether they are paying the correct amount in property taxes. Misunderstandings can result in overpayment, missed exemptions or unexpected rollback taxes that strain finances.

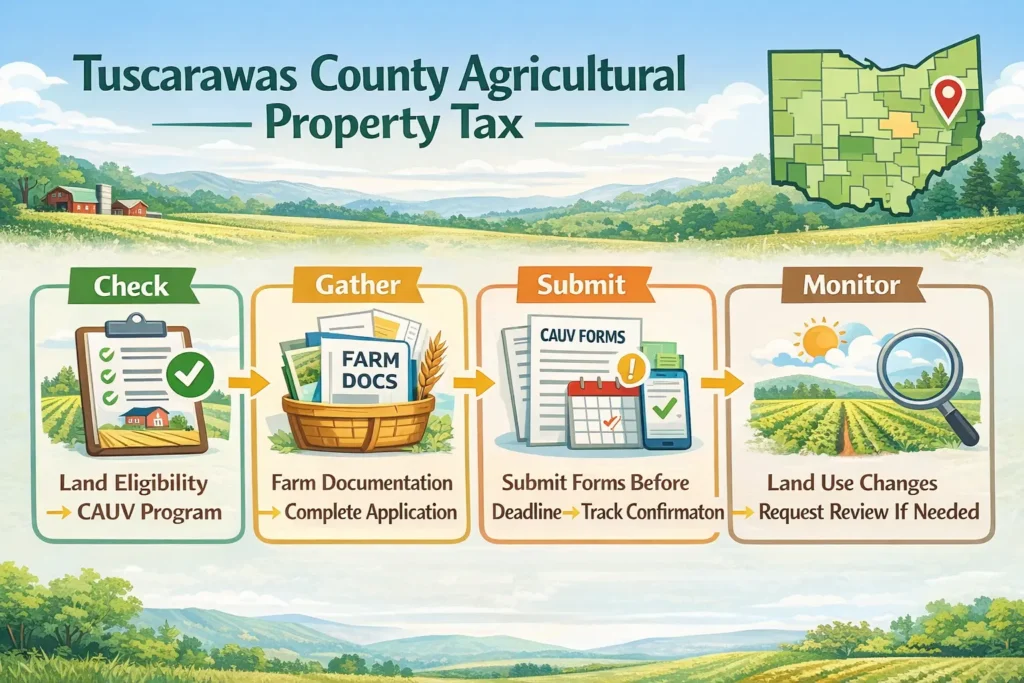

This guide is designed specifically for Tuscarawas County agricultural property owners. It provides step-by-step guidance on evaluating land eligibility, understanding CAUV calculations, navigating forms and deadlines, and ensuring fair property tax assessment. By following this comprehensive approach, landowners can reduce financial risk and take full advantage of tax relief programs.

Determining Eligibility for Agricultural Tax Exemptions

The first challenge for many landowners is determining whether their property qualifies for agricultural tax exemptions. Tuscarawas County follows strict rules, and not every plot of farmland automatically qualifies.

To check eligibility, review your property’s classification through the Tuscarawas County Auditor portal. Eligibility generally depends on whether the land is actively used for farming and meets Ohio CAUV requirements. Maintaining accurate records of farm operations, crop types, and livestock can support claims for exemptions. Understanding these criteria prevents owners from overpaying taxes and ensures they take advantage of available savings.

Understanding the CAUV Program

The Current Agricultural Use Value (CAUV) program is designed to reduce taxes on farmland by assessing land based on its agricultural productivity rather than market value. Despite its benefits, many Tuscarawas County landowners find the CAUV formula confusing.

The CAUV calculation considers soil productivity, crop yields, and statewide agricultural rates. For example, a 50-acre farm in Tuscarawas County may be assessed at a fraction of its market value under CAUV. Breaking the calculation into simple steps soil classification points, base rate and productivity factor helps landowners understand their assessed value and plan for property taxes more accurately.

Reviewing and Challenging Incorrect Assessments

Even with CAUV, errors can occur. Overvalued farmland can lead to excessive property taxes, which can be challenged through the Tuscarawas County Auditor.

Start by reviewing your property’s assessment notice. Compare your CAUV value with neighboring farms or similar plots. If discrepancies are found, landowners can file a property tax appeal. Understanding the appeal process, including forms and deadlines ensures disputes are resolved fairly and prevents overpayment.

Navigating Complex Filing and Forms

Many landowners feel overwhelmed by the paperwork required for CAUV applications, appeals, and annual filings. Forms like the CAUV application or exemption requests often require detailed farm information and careful attention to deadlines.

To avoid mistakes, download official forms from the Tuscarawas County Auditor website, read instructions thoroughly, and keep a checklist of required documents. Filling out forms accurately and submitting them on time is critical for ensuring eligibility and avoiding processing delays.

Keeping Track of Deadlines

Missing critical deadlines can cost landowners significant money or result in denied exemptions. Tuscarawas County provides clear dates for CAUV applications, appeal submissions, and rollback notifications.

Maintaining a calendar of important deadlines allows farmers to plan ahead. Setting reminders for CAUV submissions, annual assessments, and appeals ensures compliance with county regulations and helps avoid unnecessary penalties or lost opportunities for tax relief.

Understanding Potential Tax Benefits

Many Tuscarawas County landowners are unaware of the tax savings available through CAUV or agricultural exemptions. The financial impact can be substantial, depending on land size, soil productivity and current assessment.

For instance, a 100-acre farmland valued at market rates could pay several thousand dollars more annually than the CAUV-assessed value. Understanding potential farm tax reduction programs enables landowners to budget effectively and make informed decisions about managing property taxes.

Handling Multi-Use Land

Some farms include areas used for non-agricultural purposes, such as rental properties or commercial development. Taxation of mixed-use land can be confusing, as only the portion actively used for agriculture qualifies for CAUV.

Tuscarawas County requires accurate classification of each parcel. By identifying which portions of the land are eligible, landowners can calculate proration correctly and avoid overpayment. Clear documentation and GIS mapping are essential for this process.

Knowing Your Review and Audit Rights

Many owners do not realize they have the right to request audits or review property assessments if taxed incorrectly. Tuscarawas County allows landowners to file appeals or request a revaluation through the Auditor’s office.

Following a structured process gathering evidence, submitting forms and documenting communications ensures that requests are handled efficiently. Awareness of these rights empowers landowners to protect their financial interests and correct errors promptly.

Planning for Land Use Changes

Changing land from farm to non-farm use can trigger rollback taxes or increased assessments unexpectedly. Tuscarawas County calculates these adjustments based on prior CAUV benefits received.

Understanding the implications of land use changes allows landowners to plan for potential tax obligations. Consulting the county auditor before converting land ensures compliance and helps minimize surprise costs.

Communicating With Local Authorities

Finally, many landowners struggle to reach the Tuscarawas County Auditor or understand the guidance provided. Effective communication requires preparation: have documentation ready, know your questions in advance and contact the office during recommended hours.

Building a clear line of communication helps resolve issues faster, whether it’s clarifying CAUV calculations, filing forms or verifying deadlines. Familiarity with county processes reduces frustration and increases confidence in managing agricultural property taxes.

Sample CAUV Submission Timeline Table

| Step | Action | Deadline / Notes |

|---|---|---|

| 1 | Verify land eligibility | Early January |

| 2 | Gather farm documentation | Before application |

| 3 | Complete CAUV application | By submission deadline |

| 4 | Submit forms to Auditor | Check official date |

| 5 | Review confirmation and follow-up | Within 30 days |

This table helps landowners track each step and ensures timely submission of applications and related documentation.

Checklist: Managing Agricultural Property Taxes

- Confirm land qualifies for CAUV or other exemptions

- Review CAUV calculation and property assessment

- Gather required farm documentation for submission

- Complete forms accurately and before deadlines

- Track deadlines and keep a calendar

- Consider mixed-use land classification if applicable

- Request reviews or audits when necessary

- Plan for land use changes and potential rollback taxes

Conclusion

Understanding agricultural property tax in Tuscarawas County requires careful attention to eligibility, CAUV calculations, deadlines and filing procedures. By reviewing assessments, preparing proper documentation, tracking deadlines, and communicating effectively with the county, landowners can maximize tax savings and avoid unnecessary financial burden.

With structured planning and awareness of county resources, Tuscarawas County farmers can confidently manage property taxes and ensure their farmland is assessed fairly.

FAQs

1. What is the CAUV program in Tuscarawas County?

CAUV assesses farmland based on agricultural use rather than market value, reducing property taxes.

2. How do I know if my farm qualifies for exemptions?

Eligibility depends on active agricultural use, farm records and compliance with Tuscarawas County requirements.

3. Can I appeal an incorrect farmland assessment?

Yes, you can file a property tax appeal with supporting evidence to request a review or revaluation.

4. What if my land is partially commercial or non-farm?

Only the portion actively used for agriculture qualifies. Proper classification ensures accurate proration of taxes.

5. What are rollback taxes?

If land changes from farm to non-farm use, the county may recalculate taxes, often resulting in a retroactive charge.

6. Where can I get help with CAUV forms?

Tuscarawas County Auditor’s office provides guidance, instructions, and downloadable forms. Prepare questions in advance for faster assistance.