That moment when your property tax bill arrives is never pleasant. You open the envelope, glance at the number, and feel a quiet panic in your chest. You already pay utilities, groceries, repairs, insurance. This is your home, yet every year it feels more expensive to simply stay in it. What hurts most is learning later that tax relief programs existed and no one ever told you.

In Tuscarawas County, thousands of homeowners overpay because they do not know what help is legally available to them. These programs are not charity. They are built into Ohio law to protect people from being taxed out of their homes. This guide exists so you never miss that help again.

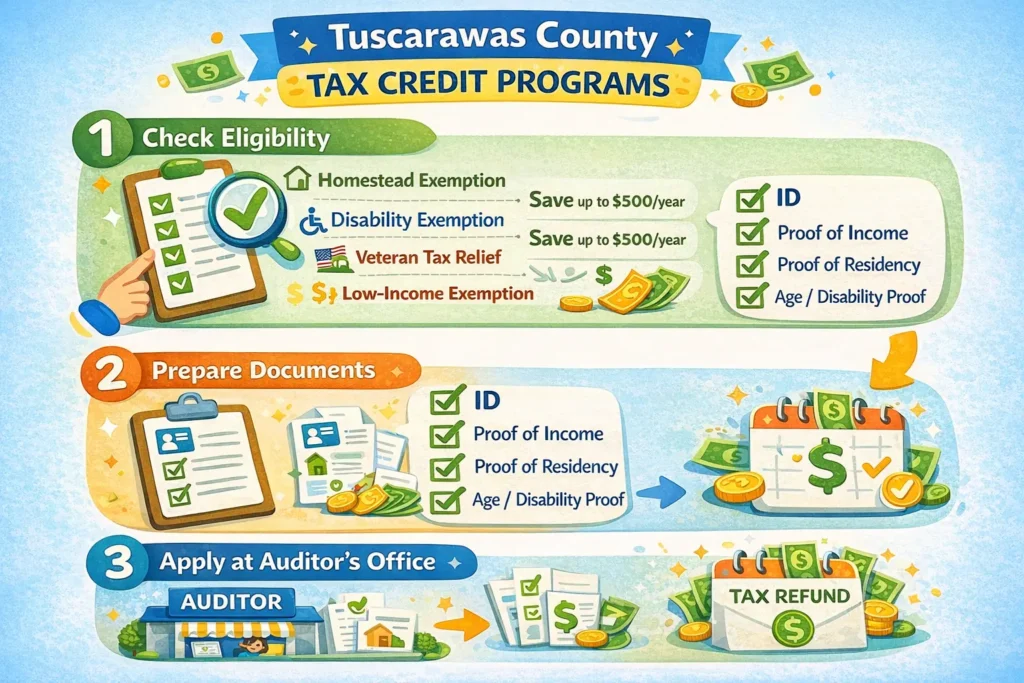

What Are Property Tax Credit Programs in Tuscarawas County?

Property tax credit programs are official county and state-approved systems that reduce how much property tax you owe on your home. In Tuscarawas County, these are managed by the County Auditor and applied directly to your property record. Once approved, your tax bill is lowered automatically each year. You do not chase refunds or file complicated claims later.

These programs fall under property tax relief, local exemptions, and Ohio tax credits designed for homeowners who occupy their property. They recognize that age, disability, income limits, and life circumstances affect what people can realistically afford. The county does not advertise them loudly. If you never ask, the system assumes you can pay the full amount forever. That silence is costly.

Eligibility Requirements for Tuscarawas County Property Tax Credits

Most people disqualify themselves before the county ever does. They assume the rules are too strict or that only “special cases” qualify. In reality, eligibility is based on a few clear factors: you must own the home, live in it as your primary residence, and meet age, income, or status requirements.

Tuscarawas County follows Ohio standards such as income limits, age thresholds, disability status, and residency rules. If you are over a certain age, living on a fixed income, managing a disability, or are a qualifying veteran, you are already in the target group. Checking eligibility is not wasting time. It is a small action that can save you hundreds every year.

Which Programs Apply to You Specifically?

Different homeowners qualify for different forms of relief. The county does not use a one-size-fits-all model. Instead, it offers programs tailored to real life situations. Seniors often qualify for the Homestead Exemption, which reduces the taxable value of their home. Disabled homeowners may qualify even if they are under retirement age.

Veterans with service-connected disabilities can receive special property tax relief. Low-income families may qualify under income-based exemptions. These programs exist because stability matters. Whether you are aging in place, recovering from injury, or supporting a family on limited income, these benefits exist to keep housing within reach.

How Much Money Can You Actually Save?

Savings depend on your home’s value and the program you qualify for. The Homestead Exemption alone can reduce the taxable value of your home by up to $25,000. With a typical local tax rate, that often translates into $400 to $600 in annual savings.

That is not symbolic. That is groceries, heating bills, medication, or car repairs. For someone on a fixed income, that reduction can determine whether the year feels survivable or constantly stressful. These programs work by lowering your assessment, which reduces your tax bill every single year you remain eligible.

How to Apply for Tuscarawas County Property Tax Credits

They only look scary because government design hates humans. In reality, most applications are two to three pages long. You provide your name, address, proof that you live in the home, and proof of income or qualifying status. That is it.

You are not writing essays or legal arguments. You are confirming facts that already exist. The Auditor’s Office processes these forms every year. They expect normal people, not experts. If you can fill out a doctor’s form, you can complete this.

You usually need:

- Proof of age or disability

- Last year’s income statement or tax return

- Photo identification

- Property information

Where Do You Apply?

All applications go through the Tuscarawas County Auditor’s Office. You can apply in person or download the forms from the official county website. The office handles filing, guidance, corrections, and status checks.

This is not a favor you are asking. It is a local government service built for residents. Walking into that office is not an inconvenience. It is exercising a right created for homeowners like you.

What Are the Deadlines?

Most programs follow an annual filing deadline, usually in early December for the next tax year. Miss it, and you wait another full year for relief. There is no retroactive credit. There is no partial refund. You simply pay the full amount again.

Deadlines exist because tax rolls are finalized early. Treat this like renewing a license. Set a reminder. Mark your calendar. Missing this date can cost you hundreds for no reason.

What If You Make a Mistake?

Mistakes do not end your chances forever. If something is missing or incorrect, you can submit corrections, provide additional documents, or reapply in the next cycle. The county allows for adjustments because the system is designed for humans.

You can file a correction request, clarify information, or ask for guidance. Errors are part of real life. They are not automatic disqualifications.

Is This Only for Perfect Records?

No. These programs are not reserved for people with flawless histories. Late payments, hardship, or back taxes do not automatically disqualify you. In fact, many of these credits exist because people struggle.

Hardship programs and exemptions are meant for real financial situations. Low income and instability do not remove you from eligibility. They often place you closer to it.

Can You Lose the Credit Later?

Yes, if your situation changes. Most programs require annual verification. If your income rises beyond limits, you sell the home, or stop living there, the benefit ends. This is not punishment. It is an eligibility review.

As long as your circumstances remain within the program’s rules, the credit stays active. It exists to match reality, not trap you.

Application Checklist: What to Prepare Before You Apply

This checklist exists so you do not walk into the Auditor’s Office or open a form and freeze. If you prepare these items in advance, the entire process can take less than twenty minutes instead of turning into a multi-week headache.

- Government-issued photo ID

- Proof that you live in the property (utility bill or similar)

- Last year’s income proof (tax return, SSA statement, pension letter)

- Proof of age or disability, if applicable

- Property address and parcel number

- Completed application form from the Tuscarawas County Auditor

- Copies of all documents (keep originals at home)

Following this checklist prevents delays, repeat visits, and unnecessary rejection of your application.

Tuscarawas County Tax Credit Programs Overview

| Program Name | Who Qualifies | Main Benefit | Documents Needed | Typical Deadline |

|---|---|---|---|---|

| Homestead Exemption | Seniors and Disabled Homeowners | Up to $25,000 reduction in taxable value | ID, income proof, residency proof | Early December |

| Disability Exemption | Permanently Disabled Owners | Reduced property tax assessment | Medical proof, income documents | Early December |

| Veteran Tax Relief | Disabled Veterans | Significant tax reduction | VA disability proof, ID | Early December |

| Low-Income Exemptions | Qualifying Low-Income Families | Lower annual property tax bill | Income proof, residency proof | Early December |

This table gives you a clear snapshot of which programs may apply to you and what you need before starting.

Conclusion:

Property tax relief is not a loophole. It is a system created to keep people from being priced out of their own homes. Tuscarawas County offers these programs because real life includes aging, disability, service, and financial strain. These are not rare situations. They are normal.

If you qualify and never apply, you leave your own money behind every year. The gap between you and that relief is not complicated law. It is awareness and a few pages of paperwork. Once approved, the benefit continues year after year as long as you remain eligible.Paying more than you legally owe is not responsibility. It is unnecessary. Your home should feel secure, not like a countdown clock.

FAQs

1. Do I have to apply every year?

Most programs require annual verification. Some require full reapplication, while others only require an income update. This ensures the benefit goes to homeowners who still qualify.

2. If my income increases slightly, do I lose the credit immediately?

No. Income limits are clear. If you exceed them, the change applies in the next cycle. There is no penalty, only an eligibility adjustment.

3. Can I apply online?

Yes. The Tuscarawas County Auditor’s official website provides downloadable forms. You can submit them by mail or in person.

4. What happens if I miss the deadline?

You must pay the full tax amount for the next year. There is no retroactive credit. Missing the deadline means waiting another full cycle.

5. Do back taxes or late payments disqualify me?

No. Payment history does not automatically disqualify you. Eligibility is based on income, status, and residency, not perfection.

6. Can I qualify for more than one program?

In some cases, yes. The Auditor’s Office will guide you toward the most appropriate and legally applicable benefit.